In a year with a record-setting number of mega-settlements (over $100 million) and high average settlement value of $44 million, claimants had to clear many more hurdles to collect the funds to which they (or their investors) were entitled.

The number of $100+ million settlements grew by 25%.

The reason? Cases are quickly evolving to unprecedented levels of complexity. Our new report details the trends that make securities class action cases more challenging than ever.

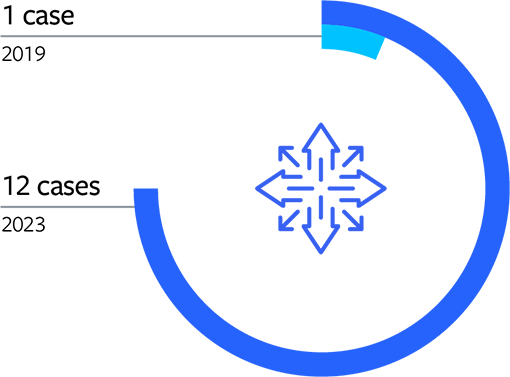

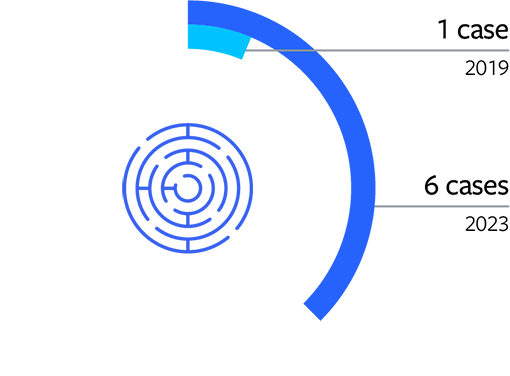

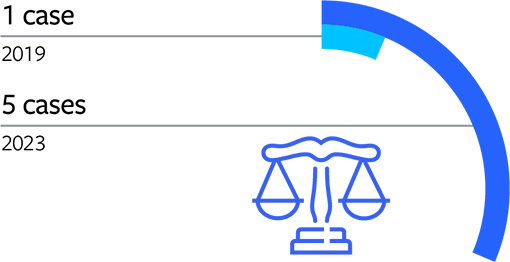

In recent years, a complex case typically involved three administrative challenges or less. In 2023, only one case had three challenges. Five cases had four challenges, three had five challenges and one had six.

The administrative challenges that are becoming much more common are:

Numerous eligible securities

Numerous eligible securities

As many as tens of thousands of CUSIPs and ISINs may be involved in a single case. Much more effort is required to identify all of the affected securities, each of which presents unique challenges. Then, all data must be correctly populated into the proper filing formats.

Corporate actions

Corporate actions

For example, separate reviews are needed to ensure that any shares exchanged in a merger are correctly categorized. Even corporate actions that occur outside the class period can influence filing of claims.

Complicated security type or instrument

Complicated security type or instrument

Portfolio monitoring is significantly more intricate in cases involving complex instruments. It can also be more challenging to determine eligibility to file a claim.

Claims under multiple securities laws

Claims under multiple securities laws

When recovery is sought under both the Securities Act and the Exchange Act, the settlement class is often divided into two sub-classes. This requires preparation of two distinct claims to maximize recovery.

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |